What Should You Do When Markets Are Volatile?

By Chris Young, CFP®, CPWA®, CMFC®

Volatility in the stock market is back after having gone missing for the last 18 months. In 2017, the S&P 500 was up every month and the largest peak-to-trough drawdown was roughly three percent. That lack of volatility is the lowest on record since the mid-1990s (Source: Barron’s). Such a benign market environment can change how investors perceive risk due to “recency bias” (the propensity to think what’s been happening recently will continue).

The market’s recent 10 percent decline has been a stark reminder that volatility and markets go hand-in-hand. The low volatility upward trending market, as we’ve experienced lately, was an anomaly and many investors were stunned to see how quickly things can change. While no one can predict with certainty if the market correction will be fleeting or turn into a longer, protracted downturn, neither can they forecast how investors will react once things correct.

Financial media outlets are quick to use words like “turbulence,” “fear,” “panic,” “distress,” “plunge,” and “bear market.” An unfortunate consequence is that the higher the market volatility, the higher the unpredictability of our emotions and the media knows that. It’s what they prey on to get you to keep tuning in.

One thing is certain, if you don’t have a plan of attack prior to the increase in market volatility, your emotions can get the better of you.

Here are 4 things to consider as volatility returns to the markets:

1) Focus on what you can control, such as your asset allocation, versus trying to time the market.

Allocation can directly affect downside risk vs. the broader markets. Although allocation might only reduce, not eliminate, risk, this is an appropriate approach when attempting to manage it. Reducing portfolio volatility can also help to reduce the volatility of our emotions.

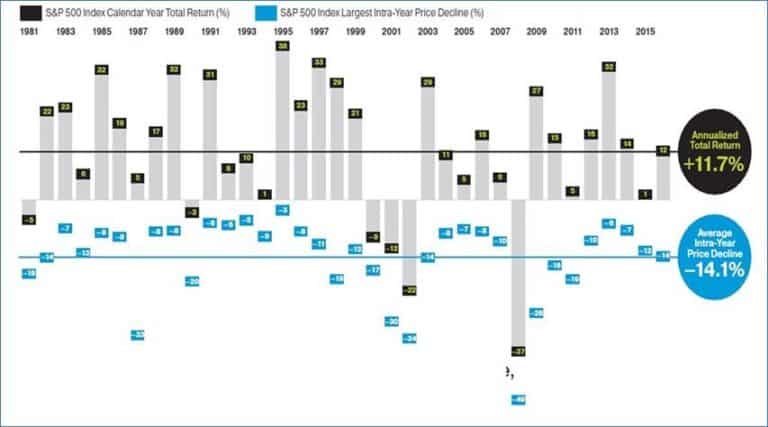

2) Intra-year declines historically have been good buying opportunities.

The chart below shows the price declines in the S&P 500 in every year since 1980 and the total return by year-end for the same time frame. It shows that despite many intra-year declines, most of the calendar years resulted in positive total returns. The average intra-year decline for all years shown is 14.1 percent while the average total year return is 11.7 percent. (Source: Oppenheimer Funds) Why is this important? It reminds us that the market generally rises over the long run, even though it may give us periods of anxiety along the way.

This chart from Oppenheimer shows price declines in the S&P 500 in every year since 1980 and the total return by year-end for the same time frame.

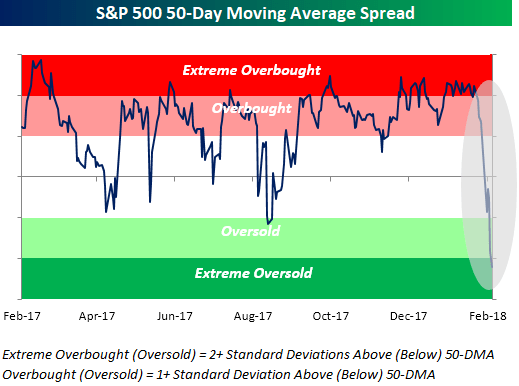

3) Markets that overshoot on the upside will also tend to overshoot on the downside.

Like a pendulum, the further it swings to one side, the more momentum it has to rebound the other way. The chart below shows the various overbought and oversold conditions over the past year, indicating just how volatile certain periods can become. It’s important during these times to remain disciplined and not deviate from your investment plan or strategy; do however recognize what’s transpiring and rebalance your portfolio as necessary to remain in line with your overall objectives.

S&P 500 50-Day Moving Average Speed chart provided by Bespoke Investment Group

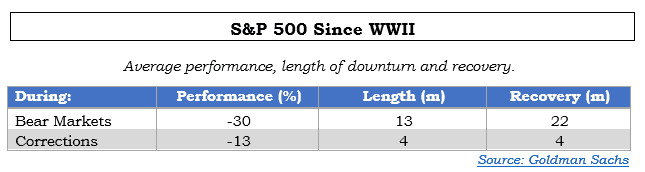

4) Market corrections are a normal and healthy part of a market cycle.

Corrections ultimately become recoveries and are usually short lived. As is evident in the chart below, the average correction lasts only four months. Keep in mind, that just because the market declines 10 percent doesn’t mean it will turn into the next 2008. Altering your portfolio for this assumed outcome, or making drastic and hasty changes when volatility spikes, could be detrimental to your portfolio over the long term.

Copyright 2018 Goldman Sachs & Co. LLC All rights reserved BY: GOLDMAN SACHS GLOBAL INVESTMENT RESEARCH DIVISION

Remembering that the vast majority of corrections aren’t that significant and are short lived makes it easier to keep calm and resist the temptation to hit the eject button at the first sign of turbulence. Still, amid a correction, you may find yourself becoming emotional and wanting to sell because you’re anxious and wanting to avoid the possibility of more pain. This approach is flawed based on Peter Lynch’s research indicating – far more money has been lost by investors preparing for corrections, or trying to anticipate corrections, than has been lost in corrections themselves.

Also, as Warren Buffett has said, “the stock market is a device for transferring money from the impatient to the patient.” So, keep calm and carry on.